Debt Service Ratio (DSR): How It Affects Your Malaysian Property Loan

When you apply for a home loan in Malaysia, one of the key factors banks consider is your Debt Service Ratio (DSR). Understanding how DSR works can make the difference between getting your dream home and facing loan rejection. So, what exactly is DSR and how can it impact your loan approval?

What is Debt Service Ratio (DSR)?

DSR is essentially the percentage of your monthly income that goes toward repaying debts. It includes existing debts like personal loans, car loans, and credit card repayments, as well as the loan you’re applying for. Banks use DSR to assess whether you can comfortably afford to repay a loan without stretching yourself too thin.

For example, if your monthly income is RM5,000 and your total debt obligations are RM2,000, your DSR is:

(RM2,000 / RM5,000) x 100 = 40%

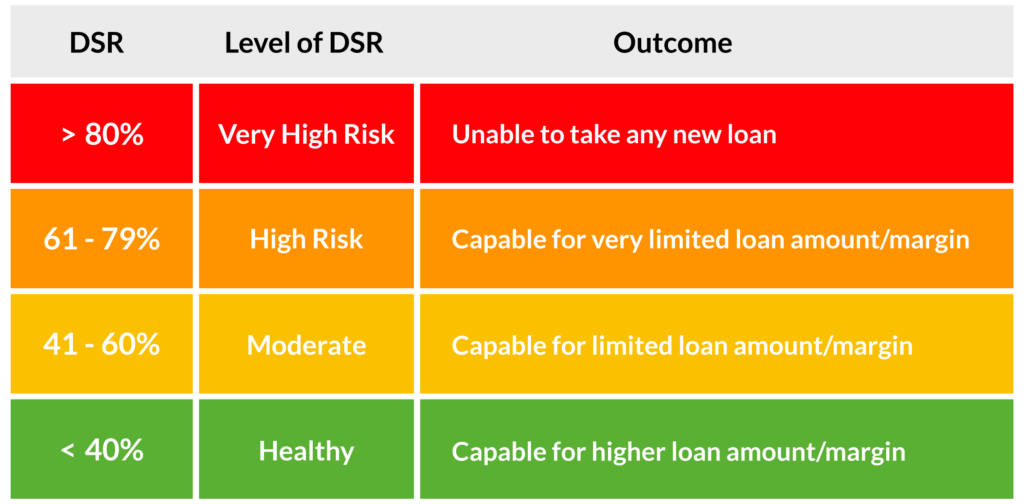

Most banks in Malaysia prefer a DSR of 40% to 60%, though this can vary based on your income level. A higher income may allow for a higher DSR, while lower-income applicants are expected to have a lower DSR.

How Does It Affect Loan Approval?

Let’s say you have a high DSR of 70%. This suggests you’re already using a large portion of your income to service debts, making it riskier for the bank to lend you more money. In this case, the bank may either reduce the loan amount you’re eligible for or reject your application entirely.

Conversely, if your DSR is 40% or lower, you’re in a much better position to secure the loan. The lower your DSR, the more likely you’ll get a higher loan amount approved.

How to Improve Your DSR:

- Pay Off Existing Debts: Try to clear or reduce your current loans before applying for a new one. Reducing your debt will lower your DSR.

- Increase Your Income: If possible, find ways to boost your monthly income. Whether it’s through side gigs, freelance work, or a raise at your job, a higher income will improve your DSR.

- Choose a Lower Loan Amount: Opting for a smaller loan or extending the loan tenure can help improve your DSR. While this might mean a longer repayment period, it can make you more attractive to lenders.

By keeping your DSR in check, you can significantly increase your chances of getting approved for a property loan and make your home-buying journey smoother.