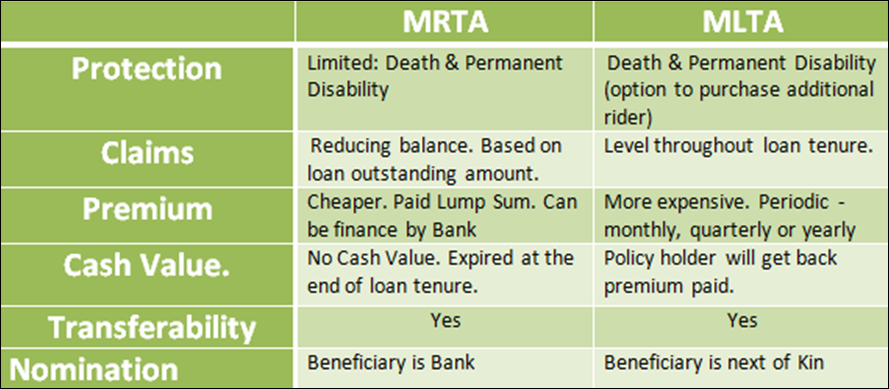

Buying a property in Malaysia can be overwhelming, especially when it comes to choosing the right insurance for your home loan. Two common options are Mortgage Reducing Term Assurance (MRTA) and Mortgage Level Term Assurance (MLTA). Both offer financial protection, but they work in very different ways. So, how do you know which one is right for you?

MRTA: Simple and Affordable, But Limited Flexibility

MRTA is tied directly to your mortgage. As your loan balance decreases over time, the coverage amount reduces as well. The idea is that if something unfortunate happens (such as death or total permanent disability), the remaining loan amount gets paid off.

For example, let’s say you have a 20-year loan. In year 10, half of the loan is paid off, so the MRTA coverage also drops by half. This makes it a cost-effective choice upfront, but once your loan is fully paid off, the policy is no longer useful.

MLTA: More Expensive, But Greater Coverage and Flexibility

MLTA, on the other hand, provides constant coverage throughout your loan tenure, regardless of how much you’ve already repaid. It can also double as a savings or investment plan. While it costs more than MRTA, the extra benefits might be worth it, especially if you want flexibility or intend to switch properties.

For instance, if you sell your house and buy a new one, you can transfer your MLTA policy to the new property. Plus, even if your loan is paid off, MLTA continues to provide coverage or cash value, acting almost like a savings plan.

What Should You Choose?

If you’re looking for a straightforward, no-frills insurance option that directly covers your mortgage at a lower cost, MRTA is your go-to. But if you want added financial security, flexibility, and potential savings or investment returns, MLTA might be the better long-term option. It all boils down to your personal financial goals and how much flexibility you want in your coverage.

This is a useful post for finding broken links within the website, what about links pointing outwards that are broken? I can use a free web service but wondered if this was possible.

Great tool! I am using a redirect plugin to send all my 404’s to my home page but I think it’s slacking sometimes.